Perhaps you’ve thought about becoming a Private Lender.

We welcome Investors to participate in our profits and they do so by becoming one of our Private Lenders.

This has the benefit of tasting how investing in real estate works while watching as we find, negotiate and buy properties. You share in the profits and when the time is right, you are buying properties for your own portfolio.

Private lenders are protected by Promissory Notes and Deeds of Trust, along with Lender’s Insurance and are handled through escrow. Rates are competitive and based depending on the amount of the loan.

You receive monthly payments or quarterly payments if you wish and you receive back the amount you invested. It’s called simple interest. That means even after all payments, you still get your principal back, it isn’t reduced. The Stock Market doesn’t promise that.

Why does this make sense for us? Because it allows us to grow faster. So, ask today about how to become a Private Lender and start making profits. It’s easy money. 602-586-9031

Also Available – Ask for details 602-586-9031

10 Low Cost Ways To Buy A House

Hi. This is Ken & Mike the Subto Guys. We’ve had a lot of requests to do monthly payments on Subto Training/Coaching. And we looked at each other and said “sure, why not”.

Special: If this is of interest to you, we have put together an introductory plan. Ask about split payments.

All bought using SubTo with little down & many, many more – you can too

I want to talk about becoming a Private Lender

This is different than putting 20% down ($80,000 on a $400,000 property) on each property you buy. That is what most people do. That alone stops most potential investors. But, set that thought aside for a moment.

What we are talking about here, is a different process. It starts with buying properties “off market”. That means you don’t find these on the MLS.

A certain amount of people are willing to sell on Creative Finance, like Subject To, (Subto) & Seller Finance for various reasons that I explain. Once an agreement has been reached, the purchase & sale go through escrow just like any other transaction.

The property can be used for a rental, fix & flip, STR or Lease Option, whatever crosses your mind. Yes, you’ll need some training, but being trained properly is a good thing anyway. Don’t let any mentor or coach tell you can do these for zero down.

Usually you can find these for $15,000 or so in “up front” money.

Here are the differences and why it can be done.

By buying “off market”, the selling price can be reduced by the amount of the fees the seller would have to pay, if they used a real estate agent. That can be a savings of $25,000 on a $400,000 property. Then, since you are taking over the seller’s loan, you have no loan origination fees and don’t have to use your credit. That saves you thousands of dollars.

And since you are getting their 3% interest rate instead of a 7% from a bank, your payment is $1,602 instead of the bank’s $2,129. A monthly savings of $527 that goes into your pocket.

Plus, since the seller has already been paying for a couple of years, the principal has been paid down $15,000.

So, you are “in” for about $15,000 and have all of these great benefits. Do 3 a year and in 5 years you are retired, and having fun.

And of course, You can continue doing these and build generational wealth.

Learn 10 Low Cost Ways To Buy A House.

- 1. Subject To (Subto) (Take over the mortgage & own the property)

- 2. Land Contract (deed transfers when last payment is made)

- 3. Wrap (seller sells with mortgage that mirrors their mortgage

- 4. Wholesale (buy below market value)

- 5. Abandoned/Zombie /Neglected (buying properties “off market” that others don’t know about, cheaply

- 6. Seller Financing (Seller becomes your bank)

- 7. Lease Option (Test the property before you buy)

- 8. Foreclosures/Probate /Distressed (Buying properties at a discount below market)

- 9. Assumption (taking over the loan of a specific property)

- 10. Joint Venture with seller or investor (buy with a partner to cut costs and risk)

For best results stay consistent in the program, but if life changes force you to miss a month or two, you can pick up where you left off when things permit.

It gives people an opportunity to see that what we do is real and to get to know us and to understand how to make money doing Subto.

If you want to start on this program, give us your email address so we can send you an outline and you can see if this plan is for you. We look forward to making you successful You’ve seen our stuff on Bigger Pockets at https://www.BiggerPockets.com/users/Mikeh695 and https://www.BiggerPockets.com/posts/user/Kenm264 now get us live and get trained for the next breakthrough for you!

I want to talk about Creative Finance

Error: Contact form not found.

Free Info & Sign Up – Click Here

All bought using Subject To and little down & many, many more – you can too

When someone says “I need time to think this over” it means they haven’t fully had their questions answered. You know that. You obviously have the interest and the skill set necessary to be successful or you wouldn’t be here

Time is fleeting and I understand the pressures, as I was fully engaged in activities/family at your age. I had to make a decision to get started to get to where I am now. Because of the way real estate and inflation work, It’s just going to get harder for those who don’t begin. Let me know what your questions are, I’m sure they are legitimate. But, you need to know for yourself, if this is for you or not.

Fence sitting doesn’t get you ahead. And being ahead, is a whole lot better than not.

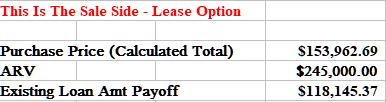

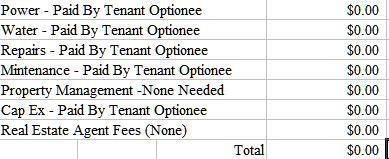

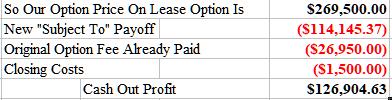

You will buy “off market”, below cost, You will get instant equity, and sell as Lease Option getting a down payment (instant cash), You will get cash flow, principal paydown, tax write offs and You will get a big chunk of cash when the optionee refinances. This takes training and some money, (IRA or 401(k) but boy does it pay off!! And We Will Teach You How!

I want to talk about Creative Finance

Error: Contact form not found.

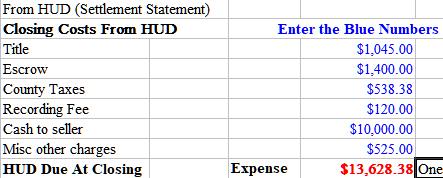

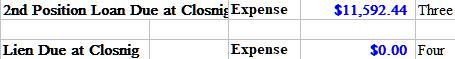

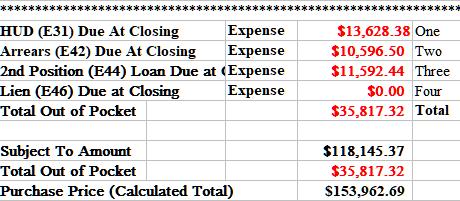

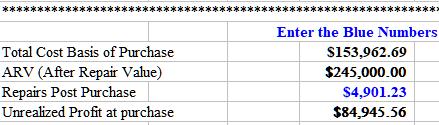

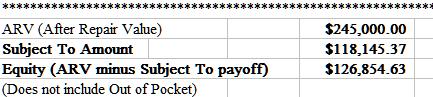

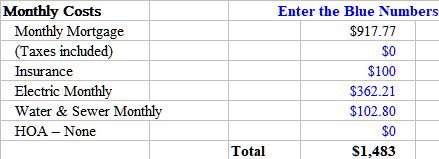

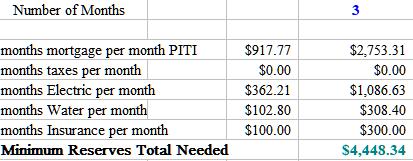

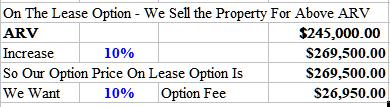

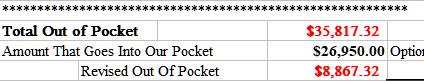

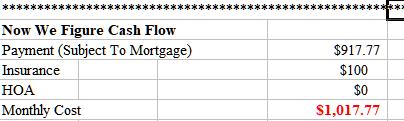

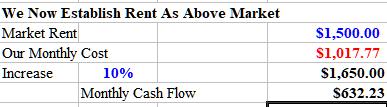

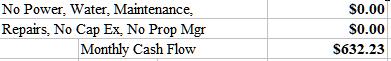

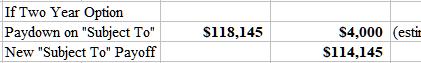

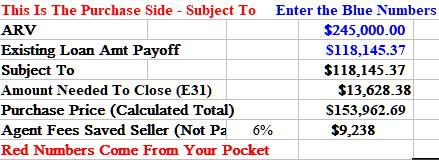

These are the numbers from a recent Purchase I made using Subject To. I took over the loan of $118,145. The ARV of the Property was $245,000

Spreadsheet Starts Here

Buying The Property Subject To

Buying The Property Subject To

Bringing the Loan Current

Add In Other Liens

Now We Total Our Costs To Purchase

Spreadsheet Starts Here

Selling the Property on Lease / Option

Selling the Property on Lease / Option